Photo by: Marc Fader

Frank Palazzolo’s Westchester County home. In one of his rare conversations with a reporter, Palazzolo denied owning any buildings. “Palazzolo is a lender,” he insisted.

This is the third chapter in a five-chapter story. Click here to see the rest of the series.

At the height of the real estate bubble, banks looking to make profitable loans on residential multifamily properties viewed Bronx real estate operator Frank Palazzolo as an excellent investment candidate. He looked good—at least on paper.

For starters, Palazzolo’s business was thriving. He was owner, partner, investor or financier in dozens of large apartment houses. He was clearly well situated in a market with an endless supply of customers: Many of his holdings were located in the borough’s northwest section, the densest residential area outside Manhattan and a stronghold of working-class New Yorkers, many of them immigrants, all in need of the city’s rarest commodity: affordable rental housing.

On a checklist of creditworthiness, Palazzolo scored high: In 10 years, he had gone from owning a handful of properties with relatives to heading a major real estate operation with several dozen associates and partners. He had established a track record of having held earlier bank loans, including two for more than $1 million. And it didn’t hurt that he ran his business out of his own modern office complex several miles north of New York City.

In the language of bankers, Palazzolo had the requisite three Cs: capital, capacity and collateral, and enough of each to handle sizable mortgages.

A few years earlier, he would have been out of luck, along with most other Bronx real estate owners. In the 1970s and early ’80s, banks were loath to offer mortgages of any size as arson, owner abandonment and city disinvestment took a huge toll on Bronx residential neighborhoods.

But by the late 1990s, when Palazzolo first went shopping for large investment funds, the market had done an about-face. Housing values were soaring, and lenders were welcoming mortgage applications like his. Loan documents were quickly assembled and approved.

A series of huge deals

One of his biggest was in 2000, when he negotiated a $35.8 million note from Dime Savings Bank of New York for his Palazzolo Realty Corporation. The mortgage loan was spread over nearly three dozen properties containing more than 1,100 apartments. Most of the mortgage went to consolidate outstanding debt already carried on the buildings. But bank officials were impressed enough with their client to advance him an additional $9 million for unspecified needs. Two years later, he presented another lender, Washington Mutual, which had taken over Dime Savings Bank, with a different roster of 34 properties, containing more than 1,000 units. Like the earlier group, each property was owned by a different corporate entity, each one listed at Palazzolo’s Scarsdale offices. The bank agreed to lend him $32 million. Again, most of the note represented consolidated debt, and again Palazzolo picked up additional cash on his trip to the bank, in this case an added $8.5 million.

Mortgage documents for the loans were filed with the Bronx County clerk. They contained standard provisions protecting the bank’s interest in the properties: All insurance would be in place; they would be maintained in good condition; “all necessary or desirable repairs” would be made; rents would be collected in compliance with all laws; environmental rules—a reference to strict laws concerning elimination of dangerous lead paint—would be obeyed. With a series of soaring loops, Palazzolo signed his name as president of each of more than 60 separate corporations holding title to the properties, agreeing to the terms and conditions. Most of the buildings had been purchased in the late ’90s by either Palazzolo or his many associates. His role, as he later explained in courtroom testimony, was to serve as a kind of arranger—someone who located properties, lent money to the actual owners and arranged financing.

Once the paperwork was complete on Palazzolo’s loan applications, the funds were released. Among the properties in the mortgages was 3569 DeKalb Avenue, the building where Jashawn Parker died. Years later, when asked on the witness stand where that mortgage money went, Palazzolo insisted most of it had gone to pay outstanding loans, contractors, fuel oil vendors and the like. But if much of the money was spent to maintain the apartment houses, there was little to show for it.

Records show that many of the properties pledged in Palazzolo’s mortgages were already in severe distress at the time the loans were made. In 2004, just two years after Palazzolo had signed off on multimillion-dollar financing deals, officials at the Department of Housing Preservation and Development said that they’d found more than 19,000 housing code violations in some 100 properties identified as part of Palazzolo’s real estate operation.

A follow-up look late last year at many of those same properties found different owners of some buildings and a few positive indications that new landlords were trying to turn things around. But the findings were otherwise stark: Despite the millions of dollars paid out to his corporations in mortgages, many of the properties involved in those deals had only tumbled further into decay.

Palazzolo himself, along with almost all of the associates whose names were listed as building owners, had managed to escape any sanctions. Thanks in part to tough New York state laws that protect individual investors from corporate liability, no one was penalized for the disastrous shape in which they left their properties. A couple of them retired to mansions similar to Palazzolo’s in leafy glades in Westchester, just a few miles north of where they had found their fortunes.

Even some of the bankers said they later came to regret their dealings with the Bronx real estate tycoon. Michael Allison, executive vice president for strategy and growth for Washington Mutual, testified in a deposition in 2007 that his bank had decided not to make new deals with Palazzolo after he refused demands for repairs on the properties.

“We communicated our desire to Mr. Palazzolo that the violations be cured,” stated Allison, “and that this would be part of what would be required for us to continue the relationship or to pursue additional relationship [sic].” Palazzolo, he testified, declined.

“He disagreed with the requirements we expected on the property,” Allison said. “He felt comfortable that his level of maintenance was appropriate for his tenants and suggested he wasn’t going to do that.”

Other bankers are blunter. “Palazzolo is persona non grata around here,” says Vincent Giovinco of New York Community Bank, which did mortgage financing with him in 2004, agreeing to lend $18.6 million to the Palazzolo Investment Group against 20 apartment buildings in the Bronx. “As long as I’m here, I don’t think he’ll get another loan,” Giovinco says. But that’s looking through the rearview mirror. By the time those regrets were voiced, the money was already long out the door and the damage was done.

Major loans amid drugs, disrepair

The experience of Cynthia Orta, in one of the heavily mortgaged buildings linked to Palazzolo, illustrates the sharp disconnect between the huge outlay of capital by lenders and everyday conditions for residents. Orta and her parents moved into an apartment at 1053 Boynton Avenue in the Bronx’s Soundview section in 2002, the same year Palazzolo negotiated his $32 million note from Washington Mutual. The mortgage included Orta’s building and two others, 1040 and 1045 Boynton, on the same block.

Standard procedure for loan underwriting requires a detailed inspection and appraisal of properties to be mortgaged. But in practice, bankers and housing officials acknowledge, such visits can be as cursory as a quick drive-by, confirming that the property exists and has the most rudimentary required elements, such as doors, roof and stairways.

A visit to the Boynton Avenue properties in 2002 would have been an eye-opening experience for any appraiser or loan officer. It would have included running the gauntlet of drug peddlers who had long preyed on the block. According to police and federal prosecutors, the stretch between the Bruckner Expressway and Watson Avenue, where Palazzolo’s properties were located, was one of the Bronx’s busiest drug supermarkets. It was the turf of a violent drug gang that marketed hundreds of bags of heroin daily to a steady stream of customers. Drug sales were at their peak, officials said, during the same period the banks were making their investment with Palazzolo.

Prosecutors said that during a two-year stretch from 2001 to 2003, drug profits on that block would hit $10,000 per day. Gang members worked in shifts, divided into managers and workers, authorities said. They conducted business from 7 a.m. to midnight, offering packets of heroin stamped with brand names of Diesel, Blue Devil, Budweiser and Warlock. When a federal judge sentenced the gang’s ringleader to 30 years in prison, he noted that the drugs and guns involved in the trade had posed “incalculable risks and damage to people on the streets.”

But if there was any calculation of those risks included in Palazzolo’s lucrative mortgage deal, it wasn’t reflected in his loan documents. By 2000, corporations based at Palazzolo’s headquarters were in control of the three buildings on Boynton. At that time, police reported scores of arrests, many of them inside the buildings mortgaged by Palazzolo. Tenants report that a new management company took over in 2010, but no deed transferring title was filed, and residents say they’re still plagued by drug dealing. In November, Orta told of continuing raids by police. “First floor, second floor, fourth floor,” she said. “It’s horrible here.”

Living conditions weren’t much better. Orta, who still lives there, estimates that in their years in the apartment, she and her family have spent $10,000 of their own money repairing the bathroom, floors and walls. “We have to pay someone to come,” she says, “or my father does the work, because he’s a carpenter.” Orta said in February that she was still waiting for building managers to take care of a gaping hole in her living room ceiling that she had been complaining about to the super and management since before November.

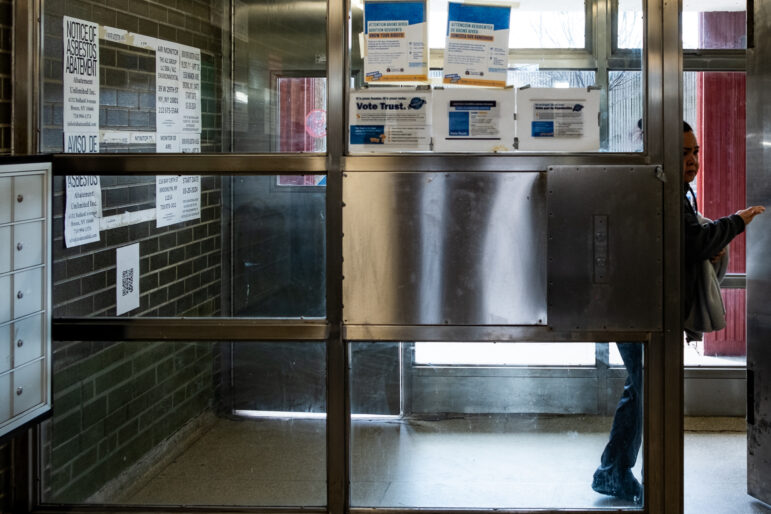

Most basic maintenance at the Boynton Avenue buildings was left up to the city. Housing department records show that from 2000 to 2004, while the buildings were being run by corporations based at Palazzolo’s Scarsdale headquarters, taxpayers shelled out more than $45,000 for emergency repairs. City-paid workers fixed boilers, ordered fuel, replaced floors and installed new windows. City workers even had to replace a front-vestibule door.

The city was also repeatedly compelled to remove lead-paint hazards from apartments with small children. In some cases, it was too late.

Andrew Matias was 7 years old when doctors determined that he had suffered brain damage. A jury later found it was from ingesting lead-paint chips flaking from the walls of apartment 1D in 1045 Boynton Avenue, where he lived from 2000 to 2003. Lawyers hired by Matias’ mother to sue the landlord later found a copy of a city department of health order dated October 27, 2000, ordering building managers to “abate the nuisance” of lead paint in the apartment.

Five years later, Alan Konigsberg, the attorney handling the case for the mother, got the young woman who had been serving as president of the building’s management corporation—based in Palazzolo’s headquarters—under oath to answer questions about the property. Nicole Pignone was just 21 years old when she headed the companies that ran the Boynton Avenue buildings. She said she didn’t recall the health department notice but was generally familiar with city rules relating to lead-paint hazards. That was because part of her job included filing required forms with the city’s housing department. “We used to receive pamphlets that explained everything about lead paint,” she said in a 2005 deposition. But she couldn’t recall whether any abatement was ever carried out.

Actually, she couldn’t tell the lawyer very much at all about the buildings because, as she acknowledged, she’d never been inside any of the apartments. She’d visited the Boynton Avenue properties “a few times,” she said, and that was only to bring the superintendent his regular pay—in cash. Her own salary, she said, depended on how much monthly rent was collected from tenants.

Even though she was listed as the president of the company, Pignone described her role, like others who worked in the Palazzolo operation, as little more than an employee. Pignone said she worked out of a one-room office in Palazzolo’s complex at 800 Central Park Avenue in Scarsdale alongside several other real estate corporations. She got the job through her father, Nicholas Pignone, who also ran several other Palazzolo-tied firms. She had no background in real estate, she said, other than having done secretarial work for her dad. She acknowledged that she was president and one of two stockholders in a series of management firms, all of them called WDJ Realty with a succession of Roman numerals after their names. For instance, WDJ Realty IV managed 1040 Boynton Avenue; WDJ Realty V managed 1045 Boynton.

But she didn’t recall whether she paid anything for her shares and said she received nothing for them when she left the business in 2004 to become a drapery saleswoman. Asked whether she’d had any conversation with anyone from the company before she came to be its president, she drew a blank. “I don’t remember,” she said. Actual ownership of the properties was another mystery. “Well, the corporation is the owner,” she offered.

In 2008, Andrew Matias’ lead-paint case went to trial in the Bronx, where a jury awarded him and his mother $8.5 million in damages (later reduced to $2.3 million). Not that it did them much good. Despite the mortgage contract requirements, attorneys for the corporations said there was no insurance policy in force at the time of the injury. Nor was there anything else of value. By the time Matias and his mother moved to collect, the WDJ corporations had shed the Boynton Avenue properties and had no other assets. Konigsberg, the attorney, managed to seize a few thousand dollars remaining in one bank account, but that was it. Frank Palazzolo, whose name appeared only on the mortgage documents, was well beyond reach.

A rat bite in the dark

The “phantom landlord” scenario repeated itself at several other buildings in the Palazzolo portfolio where abysmal conditions were endured by residents in spite of the massive property loans. One of them was a five-story apartment house about a mile from Yankee Stadium in the Bronx’s Morrisania section. The building, 465 East 167th Street, was part of the same roster of properties approved for the $32 million loan by Washington Mutual in 2002. That year, city housing inspectors flagged 318 violations at the building, according to court documents, even though it had only 23 apartments on five floors.

The property was owned and managed by a company called Pipe Dreams Realty, also based at Palazzolo’s Scarsdale headquarters. As at the Boynton Avenue buildings, records show the city was forced to handle the big jobs: City-paid crews replaced collapsing bathroom ceilings and floor joists, cleared toilet stoppages, repaired kitchen floors and installed new treads on the fire escape. Repair workers made more than two dozen visits, at a cost of thousands of dollars, to test and remove lead paint from apartments where small children lived. In all, taxpayers paid almost $70,000 for emergency repairs at the building from 2000 to 2008 while it was owned by the company based at Palazzolo’s headquarters.

Even those expenditures didn’t keep tenants safe. On April 13, 2002, a rat scurried in at 2 a.m. and bit a woman named Mary Phoenix as she slept in her bed in apartment 12. Phoenix, 56, had lived there for 32 years, so she wasn’t unfamiliar with the building’s problems. But the rodent attack held a special terror for another reason: She was blind.

“It came over my head from the head of the bed and bit my finger,” she said in a 2005 court-ordered deposition after she found a lawyer who filed suit. Phoenix said rats had plagued her apartment for years, darting from behind the kitchen sink. On another occasion, she testified, one bit her daughter. Exterminators came “once in a blue moon,” she said, but would only toss a bag of poison in a corner and be gone. In frustration, Phoenix testified, she wrote a letter to Pipe Dreams Realty complaining about the rodents. She said she got no response. She also called the city for help. “I was calling them, and sometimes they fix things when the landlord won’t do it,” she said.

Attorneys representing Pipe Dreams Realty filed their own court papers describing the injury as an “alleged rat bite” resulting in “a superficial laceration.” But as in the Boynton Avenue lead-paint litigation, questions about who actually owned and ran the building produced only muddled answers. At the time of the rat bite incident, a woman named Patrice Santangelo was listed as both chairman of Pipe Dreams and managing agent for the property. Like Nicole Pignone, Santangelo had only the vaguest knowledge about the property for which she was responsible. How had she come to be the owner? “I think that I was passing by the building, and I met people in the lobby,” she responded under oath in a deposition. If so, it was one of her few visits there.

She spent her workdays handling secretarial chores in another office at Palazzolo’s Scarsdale complex, visiting the Bronx property “a couple of times,” she said. But she had no memory of receiving violation notices from the city and knew nothing about the massive mortgage that Palazzolo had taken out, one that included the property she ostensibly owned. Asked if Palazzolo had been an officer of Pipe Dreams, Santangelo said she had no idea. “I don’t know how any of the corporate setup was,” she said. Palazzolo came to the office “from time to time,” she said, but she was hazy about his exact role: He was “doing the financing, part of the building or something like that,” she said.

Santangelo said she called it quits in 2003 because, among other reasons, she wasn’t making any money. “After I paid the bills, if there was anything left in the checking account, which there never was, I was supposed to be paid,” she said in her deposition. “We kept losing money.”

She said she spoke to Palazzolo about wanting out, and not long afterward, a man named Marc Sarfati walked into her office. “He said, ‘Maybe I can take over what you’re doing,’”she testified. The deal she struck, she said, was that Sarfati would eventually pay her for her shares in the corporation if the building turned a profit. According to a deposition he gave, Sarfati acknowledged that was the deal, adding the price was to be $50,000. But both acknowledged no money was ever paid.

Real estate management was also new to Sarfati: His prior business was running a delicatessen. But inexperience didn’t much matter. Sarfati, who described himself as a friend of Palazzolo’s in his own deposition, acknowledged that he never even visited the building once he became an officer of Pipe Dreams in 2003. Nor was he aware of the flood of code violations issued by city inspectors.

Sarfati told Phoenix’s attorney that he served as president of Pipe Dreams, while another friend, Mark Bassani, was vice president. For a rookie landlord, he had a lot of management responsibilities: Records show Sarfati and his wife Edith were at one time listed as officers of at least a dozen other corporations owning buildings in the Bronx. But when asked in his deposition, Sarfati described his day-to-day role only as “office coordinator.” And as for obtaining any compensation for Phoenix, he told the lawyer they were out of luck. In an affidavit filed in the court case, Sarfati stated that—despite the language in the $32 million mortgage obligating all properties to be insured—there was “no liability insurance on the building known as 435 East 167th Street.”

Phoenix’s attorneys, Joseph and Andrew Fallek, took one more stab at tying Palazzolo—and his deep pockets—directly to the property. In legalese, it’s a tactic called piercing the corporate veil, in which a judge is asked to hold an individual personally responsible for corporate misdeeds on the grounds that he had used the corporation to hide his own involvement. Citing the big $32 million mortgage with Palazzolo’s name and signature all over it as evidence, Fallek made his pitch in a 2007 motion: Pipe Dreams Realty, he stated, was “a sham corporation.” The real owner, he said, was Palazzolo. And the East 167th Street building had been kept highly mortgaged and uninsured, he claimed, as a means of preventing people just like Phoenix from “collecting damages against the corporation or building.”

Palazzolo’s attorney fired back. This was simply an effort to “harass, coerce and strong-arm” his client, he stated in his motion papers. Palazzolo, he wrote, “has no personal ownership or involvement in the maintenance of this building.”

But the legal showdown never took place. Phoenix died, and her lawyer moved on. Palazzolo declined to discuss anything with reporters for this article. As for Sarfati, he now lives in a luxury high-rise on Manhattan’s West Side. He and his family have another, very different claim to fame: Daughter Lea Michele is a star of the hit TV show glee. He and his wife have been cited on gossip websites alongside their famous daughter, but he wasn’t interested in discussing his real estate experience. In November, outside his residence, Sarfati paused to listen to a request from two reporters to discuss his dealings with Palazzolo.

He shook his head. “We ended on bad terms,” he said before walking away.