Photo by: NYS OTDA

Public benefits are meant to provide assistance to low-income individuals and families. Benefits come in the form of cash grants, food assistance programs, tax credits and subsidized health insurance.

Food, cash and heat

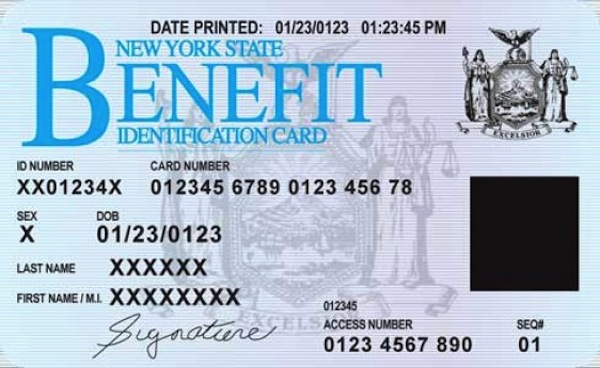

For families without a sufficient amount of food, the New York State Office of Temporary and Disability Assistance offers several nutrition assistance programs. The largest of these programs is the Supplemental Nutrition Assistance Program, which provides families with electronic benefits that can be used to purchase food at authorized stores. SNAP is the new name for the Food Stamp Program. You can apply for SNAP online on the New York public benefits website.

Eligibility for SNAP is based on income, family size and whether or not there is an elderly or disabled member of the household. The Office of Temporary and Disability Assistance provides an outline of maximum income amounts to help determine if you are eligible to receive SNAP benefits. If you are still unsure, there is a prescreening process for all state assistance programs.

In addition to SNAP, the School Meals program allows children from low-income households to receive free or reduced priced breakfasts and lunches from participating schools. Participating schools provide applications for the School Meals Program. Applications can be submitted to the school at any time during the school year. Families receiving SNAP benefits only need to submit a certification letter from the state or local department of social services to the school to receive benefits.

Women and young children in need of supplemental nutrition are also eligible for the WIC program. WIC provides food, nutrition education and breastfeeding support to low-income pregnant or postpartum women and infants and children up to age five. You must apply for WIC in person at your local WIC providing agency.

Along with nutritional support, there are also assistance programs to help with heating costs. The Home Energy Assistance Program helps low-income New Yorkers cover the cost of heating their homes. HEAP assists with the monthly cost of home heating, and the cost of replacing heating equipment. Eligibility and benefits are based on household income, size and primary fuel source. You can apply for HEAP online along with SNAP.

A more general assistance program is Temporary Assistance, which provides cash payments to help pay for everyday living expenses. Temporary Family Assistance is a benefit program for families with minor children funded by Federal Temporary Assistance for Needy Families. Family Assistance benefits can be received for a total of 60 non-consecutive months. Temporary Assistance is also offered to individuals and families who are not eligible for other benefit programs. Safety Net Assistance provides benefits to single adults, childless couples and families not eligible for Family Assistance. Cash benefits can be received for two years, after which benefits will be offered in non-cash forms such as two party checks. To apply for either form of Temporary Assistance, you should fill out an application, and file it with your local department of Social Services.

Tax credits

The city, state and federal governments also offer tax credits for low-income workers. The Earned Income Tax Credits are tax benefits meant to provide incentive for working and lower the tax burden on low-income workers. If you are eligible for the EITCs then you can get money back on both your federal and state tax returns. To be eligible for the tax credits, you must have worked either full or part time at some point during the year. You must also make below a certain amount, which changes each year. To receive the New York City EITC you must also be a resident of the city, claim the federal EITC and file a New York State tax return.

In addition to the EITCs, working parents may also be able to claim the Federal and State Child Tax Credits. The Federal Child Tax Credit is offered to workers with dependent children under the age of 18. The CTC is worth $1,000 per child, and is used to reduce the family’s income tax liability. After a certain income level, the $1000 per child benefit is reduced. Families eligible for the Federal CTC may also receive the state CTC. Parents who meet certain income thresholds and have qualifying children can receive up to $100 per child, or 33 percent of their allowed federal credit.

New York State also offers an income tax credit for non-custodial parents. To be eligible for this tax credit, you must be a noncustodial parent, have a child support order through New York State for at least half of the year, and have paid the current amount of child support owed for the given year. The credit is equal to either 2.5 times the federal EITC if you had no children, or 20% of the federal EITC for parents with one child.

Insurance

New York State offers several programs to help residents pay for medical care. The most widely known insurance program is Medicaid. If you meet certain financial requirements or have particularly high medical expenses, then you may apply for Medicaid. The New York State department of Health offers a guide to help you figure out if you are eligible for Medicaid, or any other state health benefits.

Families with children under the age of 19 have a choice between children’s Medicaid and Child Health Plus, a low-cost insurance for children provided by the state. Children not eligible for Medicaid can enroll in Child Health Plus, which offers varying premiums based on income and family size.

Adults between the ages of 19 and 64 who are not eligible for Medicaid can apply for Family Health Plus. Family Health Plus is available to single adults, couples without children and parents in New York State. Like Child Health Plus, this program provides coverage with low premiums and co-payments.

To apply for Medicaid, Child Health Plus or Family Health Plus, you must fill out the Access New York Health Care Application. Applications can then be submitted to your local department of social services. Hard copies of applications can be obtained by calling New York Health Options at (855) 693-6765.

In addition to health coverage, New York State offers several programs to help cover the

cost of prescriptions. New York Prescription Saver is a pharmacy discount card that lowers the cost of prescriptions by up to 60% on generics, and 30% on name brands. If you are between the ages of 50 and 65, make less than $35,000 and do not receive Medicaid, then you are eligible for NYPS. You can apply for NYPS by filing out an online application or calling 1-800-788-6917. If your application is approved, then you will receive your discount card within two weeks.

Residents above the age of 65 making less than $35,000 may be eligible for Elderly Pharmaceutical Insurance Coverage. This program helps cover the cost of prescription drugs for low-income residents who receive Medicare part D benefits.

To apply for EPIC, you can print out an application and send it to EPIC, P.O. Box 15018, Albany, NY, 12212-5018. You can also call 1-800-332-3742 for application assistance.

The Community Service Society of New York offers several tools for accessing public benefits. They can be found here>